Is Medicare Part D confusing? Want a fast and easy 2018 Part D breakdown … Well look no further, we can help.

2018 Medicare Part D Breakdown

All Part D Medicare drug plans work the same as far as their coverage levels, they just offer different copayments and/or deductibles.

Deductible

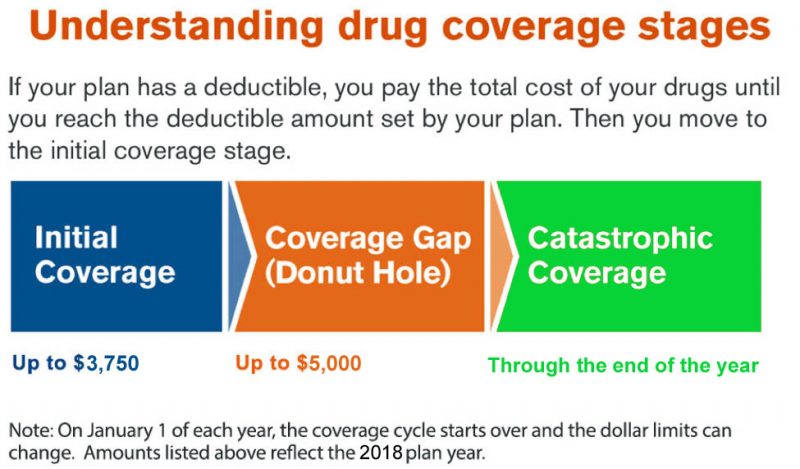

If your plan has a deductible, you pay the total cost of your drugs until you reach your deductible set by your plan … then you move on to the initial coverage level.

Initial Coverage Level – $3,750

During the initial coverage level you pay your copay amounts set by your plan until your total drug cost reaches $3,750. The total drug costs is the amount “you and the insurance company” pay. Then you move to the coverage gap level, or “donut hole”

Coverage Gap Level / “Donut Hole” – $5,000

During the coverage gap level, you pay either a higher copay amount, or discounts until you pay a total in out of pocket expenses of 5,000. Out of pocket expenses is just the amount “you” pay. Then you move to the catastrophic coverage level.

Catastophic Coverage Level – Unlimited

The catastrophic coverage level is where you will pay generally the least copay amount until the end of the year at which time the plan will renew.

This fast and easy 2018 Part D breakdown is not company specific. If you need a specific quote for your Medicare 2018 drug plan click here.

Only some drugs are covered under part B of Medicare, but most drugs are not. You want to make sure that you get a separate drug plan when you become “eligible” for Medicare Part D, in order to avoid the future penalty.